A Roadmap to Your Dream Lifestyle – Issue #97 (4 min read)

Having come across numerous tweets about retiring at 35 and the pursuit of financial freedom, I was inspired to write this newsletter and offer my own viewpoint on the topic.

Imagine a day where you wake up naturally, without an alarm clock’s irritating buzz, decide to take a walk along the beach or a nearby park, read a book, or simply enjoy a leisurely breakfast with loved ones. You’re not thinking about that presentation, the pending emails, or the monotony of a 9-5 job. You’re living your dream day, every day.

Financial freedom is a concept that has captured the imagination of countless individuals. The idea of living life on your own terms without being tethered to a job that drains your soul is indeed appealing. So, how does one transition from this dream to reality? The answer might be simpler than you think.

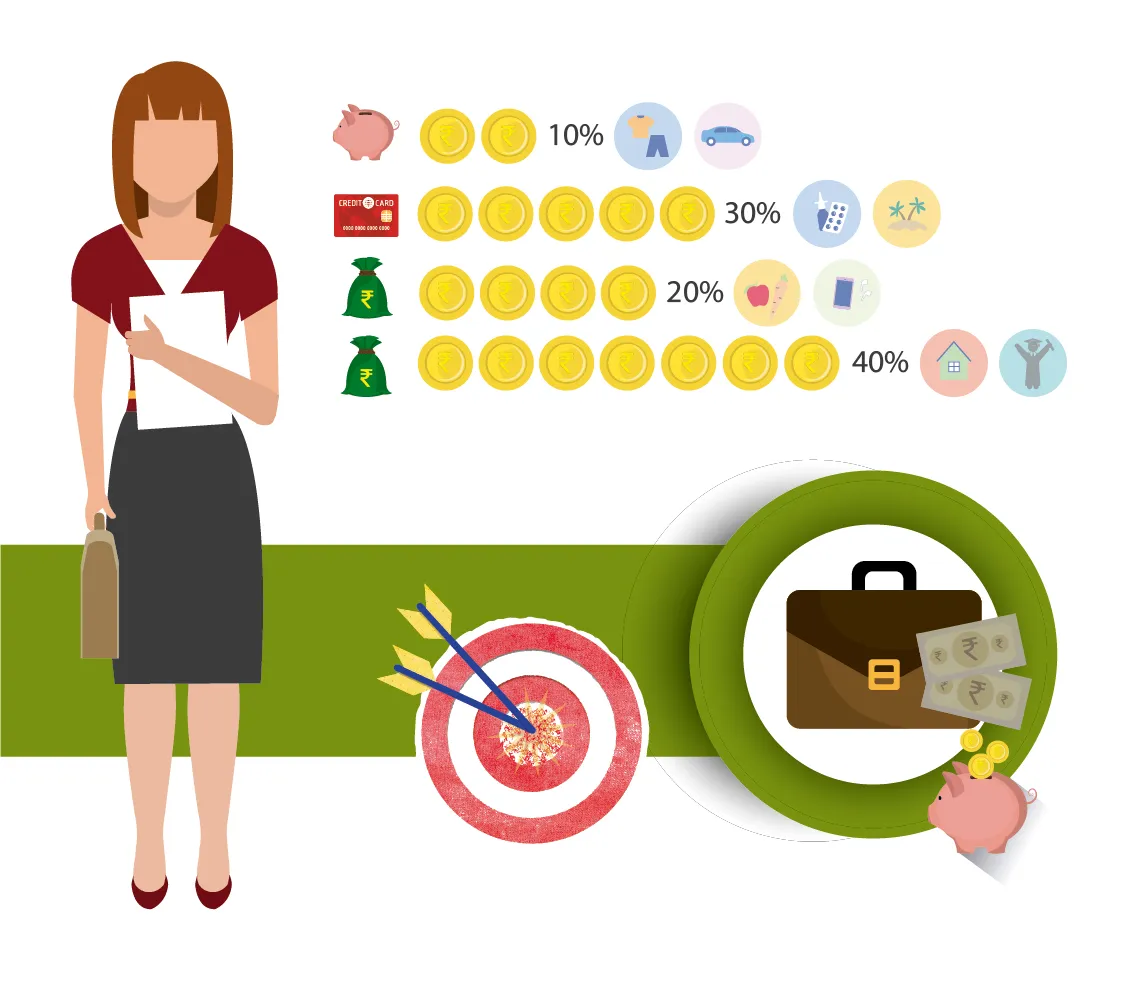

1) Protect What You Have

Your journey to financial freedom starts with what you currently possess.

Insurance: The first line of defence is safeguarding yourself and your assets against unforeseen events. Whether it’s health insurance, life insurance, or insuring key assets like your home and car, it ensures that a single unfortunate event doesn’t wipe out your savings.

Emergency Funds: Life is unpredictable. Having 3-6 months of living expenses set aside in a liquid fund ensures that you are not forced to dip into your investments or take on debt during emergencies.

Debt Management: While some debts, like mortgages, can be considered “good debt,” high-interest liabilities such as credit card debt are detrimental. Work on paying off debts as quickly as possible, so they don’t erode your wealth. Remember, the most empowering financial position begins with zero debt.

2) Compound Your Capital

Albert Einstein is often quoted as saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” The power of compounding can’t be emphasised enough.

Start Early: Even small amounts invested early in life can grow into substantial sums over time. The magic lies in allowing your returns to generate their own returns I began my savings journey with my first pay check in 1994, funnelling it into my EPF account. As soon as I could, I began doubling my contributions to that very account.

Diversify Investments: Don’t put all your eggs in one basket. By diversifying your investments across assets like stocks, bullion, real estate, and others, you mitigate risk and have a better chance of consistent growth.

Stay Informed: Financial markets and investment avenues evolve continuously. Keep yourself educated, or consult with financial advisors to make informed decisions.

3) Focus on Your True Desires

Financial freedom isn’t just about amassing wealth; it’s about knowing what you want in life. This is the toughest of the three stages. In today’s age, it’s easy to be swayed by the allure of social media influencers, which can sometimes cloud our judgment. Contrary to popular belief, you might actually find value and purpose in maintaining discipline and honouring 9-5 commitments.

Define Your Dream Day: What does your perfect day look like? Travelling? Volunteering in a NGO? Pursuing a hobby? Your investments and financial goals should align with this vision.

Cut Unnecessary Expenses: Recognise the difference between wants and needs. Cutting down on frivolous spending can free up more money for investments and bring you closer to your freedom.

Create Passive Income Streams: This might be the most crucial step towards financial freedom. Investments that generate regular income, like dividend stocks or rental properties, mean you’re earning money even when you’re not actively working. Throughout the years, I’ve strategically invested so that the rental income from my property investments cover our household expenses. Meanwhile, the revenue I generate from passion projects, like wildlife photography, addresses my personal expenditures.

The journey to financial freedom is as much an internal exploration as it is an external one. It’s about understanding oneself, being resilient against temptations, and having a clear vision. The path to financial freedom is filled with temptations.

The latest tech gadgets, impromptu vacations, or even that coffee that seems like just a small expense – they all add up. Discipline isn’t about extreme frugality but about making informed decisions. Knowing your ‘Why’ is very important. Having a clear purpose acts as a beacon, guiding you during times of uncertainty or when faced with tough decisions. Financial freedom isn’t reserved for the elite or for people with inherited wealth. With the right mindset and tools, anyone can chart their course towards this coveted goal and embrace the life they’ve always dreamt of.